DESOTO, TX WINTER WEATHER UPDATE | JAN 9, 9:08 AM

Due to the inclement weather, City of DeSoto offices and facilities are closed today, Thursday, January 9th and Friday, January 10th. For winter weather updates and resources visit our online Winter Weather Hub at desototexas.gov/weather.

WARMING CENTER

The Warming Center will be open today, January 9, 2025 through Friday, January 10, 2025 from 7 a.m. to 7 p.m. Please note that the center’s hours may be subject to change based on facility conditions. Be sure to check this page regularly for any updates on the warming center schedule and weather-related announcements. Location: City of DeSoto Civic Center-Bluebonnet Room, 211 E. Pleasant Run Road, DeSoto, TX

DeSoto ISD

Therefore, out of an abundance of caution and in the interest of safety, DeSoto ISD schools and offices will be closed on Thursday, Jan 9, 2025 and Friday, Jan 10, 2025.

Campuses and offices are expected to reopen for normal business on Monday, January 13, 2025.

Neighborhood Collaboration Workshop VIRTUALLY/Utilities Blitz Canceled

EVENT UPDATE: Due to the winter storm, the Neighborhood Collaboration Workshop will now be held VIRTUALLY and the Utilities Blitz event has been CANCELED.

Date: Saturday, January 11, 2025

Platform: VIRTUAL on Zoom

Revised Schedule:

Session 1: 10:00 AM – 10:45 AM

Session 2: 11:00 AM – 11:45 AM

CLICK THIS LINK to join available sessions. You do not need to register. https://www.ci.desoto.tx.us/…/homeowners_and…/index.php

If you have pre-registered, you will receive a direct link to your classes via email.

PLEASE NOTE: The Utility Assistance Blitz has been CANCELED!

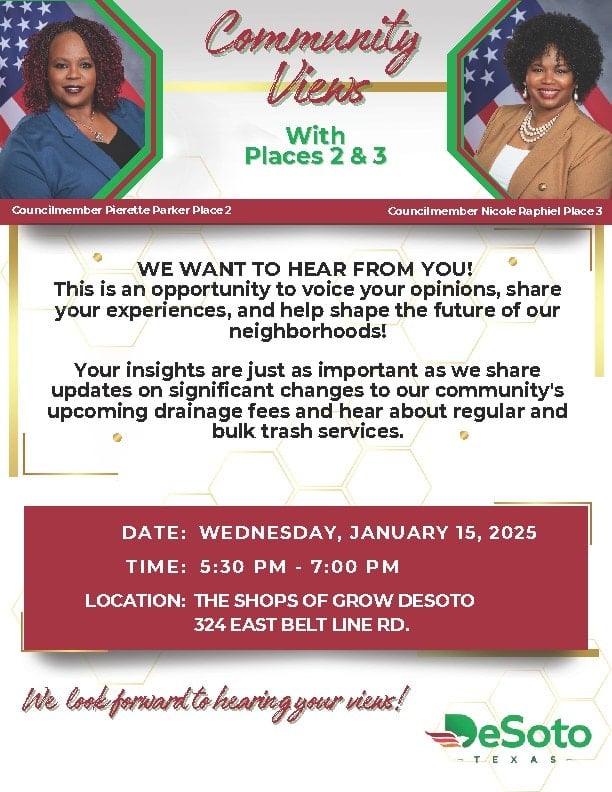

DeSoto Community Views Rescheduled

EVENT UPDATE: Due to the expected weather conditions, the Community Views event with Councilmember Pierette Parker and Councilmember Nicole Raphiel has been rescheduled to Wednesday, January 15, 2025 from 5:30pm to 7pm.

It will take place at The Shops of Grow DeSoto, located at 324 East Belt Line Rd.

The post DeSoto, TX Winter Storm Closures 1/10/25 appeared first on Focus Daily News.